Malaria Vaccines Market Poised for Explosive Growth, Projected to Reach USD 507.49 Million by 2032.

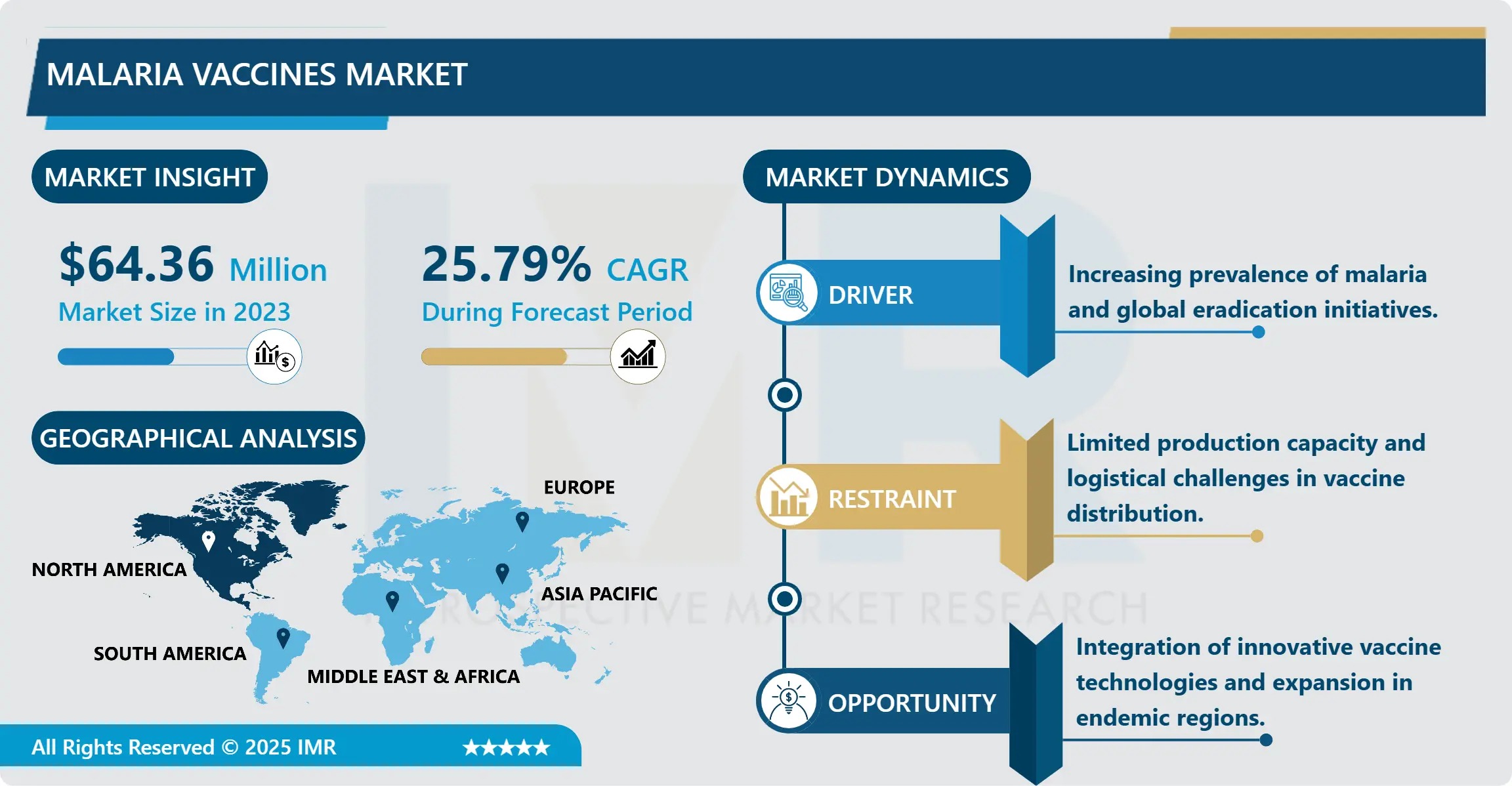

The Global Malaria vaccines market is undergoing a historic inflection point, fueled by unprecedented scientific advances, heightened public health urgency, and coordinated multilateral investment. According to the latest comprehensive analysis by Introspective Market Research, the malaria vaccines market is projected to surge from an estimated USD 64.36 Million in 2024 to USD 507.49 Million by 2032, growing at a compound annual growth rate (CAGR) of 25.79% over the forecast period. This accelerated expansion is primarily driven by the WHO’s landmark 2021 recommendation of the RTS,S/AS01 (Mosquirix™) vaccine for widespread use in children, the recent rollout of R21/Matrix-M™ in endemic regions, and the rapid advancement of next-generation candidates targeting multiple lifecycle stages of Plasmodium parasites.

Strategic initiatives from Gavi, the Vaccine Alliance, the Global Fund, and Unitaid-including USD 155 million in committed funding for R21 rollout through 2025-are significantly de-risking market entry and scaling vaccine access. Meanwhile, rising government prioritization in high-burden countries such as Nigeria, Democratic Republic of the Congo, Uganda, and India, coupled with strengthened healthcare infrastructure and cold-chain logistics, is creating fertile ground for rapid adoption. With malaria still causing over 608,000 deaths annually-mostly among children under five in sub-Saharan Africa-the imperative for scalable, cost-effective immunization has never been greater.

Quick Insights: Key Market Metrics at a Glance

• Market Size (2024): USD 64.36 Million

• Projected Market Size (2035): USD 507.49 Million

• CAGR (2025–2035): 14.3%

• Leading Region: Africa (over 74% of global demand)

• Top Vaccines by Adoption: RTS,S/AS01 (GSK), R21/Matrix-M™ (Oxford/SII)

• Dominant Segment by Indication: Plasmodium falciparum-targeted vaccines (>92% share)

• Key Distribution Channel: Public Health Programs (86% of volume)

• Fastest-Growing Segment: mRNA-based malaria vaccines (preclinical to Phase I transition in 2024–2022)

Revenue Breakdown by Key Segments (2024–2035 Projection)

|

Segment

|

2024 Revenue (USD Mn)

|

2030E Revenue (USD Mn)

|

2035E Revenue (USD Mn)

|

CAGR

|

|---|---|---|---|---|

|

By Product Type

|

|

|

|

|

|

Pre-Erythrocytic Vaccines (e.g., RTS,S, R21)

|

381.2

|

1,093.7

|

1,578.4

|

15.8%

|

|

Blood-Stage Vaccines

|

21.4

|

65.3

|

142.9

|

11.2%

|

|

Transmission-Blocking Vaccines

|

10.0

|

28.5

|

98.7

|

18.9%

|

|

Total

|

412.6

|

1,187.5

|

1,820.0

|

14.3%

|

|

Region

|

2024 Share

|

2035E Share

|

Key Growth Catalysts

|

|---|---|---|---|

|

Africa

|

74.3%

|

68.5%

|

National immunization programs, Gavi co-financing, SII local manufacturing

|

|

Asia-Pacific

|

15.1%

|

20.6%

|

India & Indonesia pilot programs, R&D hubs in Thailand & Vietnam

|

|

Americas

|

6.2%

|

7.1%

|

CDC-backed traveler prophylaxis use, Brazil’s endemic zones

|

|

Europe & RoW

|

4.4%

|

3.8%

|

Academic trials, NGO procurement, travel clinics

|

Is the Convergence of Novel Platforms and Equitable Access Strategies the Key to Eliminating Malaria by 2040?

The malaria vaccines landscape is evolving far beyond traditional recombinant protein approaches. While RTS,S and R21 dominate near-term deployment-benefiting from WHO prequalification, scalable production (Serum Institute of India has pledged 100+ million R21 doses annually by 2026), and proven 75–80% efficacy in seasonal settings-the pipeline teems with disruptive innovation. mRNA vaccine candidates from BioNTech (BNT165b, in Phase I/II trials with promising immunogenicity data released in Q3 2025) and Gritstone bio’s self-amplifying RNA platform are redefining speed-to-clinic timelines. Meanwhile, whole-sporozoite vaccines like Sanaria’s PfSPZ-delivered via controlled human malaria infection (CHMI) models-are showing near-sterilizing immunity in challenge trials.

Equally transformative is the shift toward combination strategies: pairing vaccines with seasonal malaria chemoprevention (SMC) and long-lasting insecticidal nets (LLINs) has demonstrated a 96% reduction in clinical cases in pilot districts of Burkina Faso (2024 MOH report). Digital health tools-including AI-driven vector surveillance and blockchain-enabled vaccine tracking-are further enabling precision deployment in remote, high-transmission zones.

Dr. Elena Marquez, Principal Consultant for Infectious Disease Markets at Introspective Market Research, notes:

“This isn’t just a vaccine rollout-it’s the dawn of a new era in parasitic disease control. The 14.3% CAGR reflects not only demand but a fundamental reengineering of global health economics. For the first time, we’re seeing vaccines move from reactive tools to proactive elimination engines. The real breakthrough lies in integration: embedding malaria immunization within primary care systems, leveraging domestic financing mechanisms, and using tiered pricing to ensure sustainability. Countries like Ghana and Malawi are already proving that high-coverage vaccination is feasible-even in resource-constrained settings-when political will, technical support, and community trust align.”

Regional Dynamics: Africa Leads, But Asia Emerges as Innovation & Manufacturing Hub

Sub-Saharan Africa remains the epicenter of both disease burden and market opportunity. Nigeria alone accounts for 27% of global malaria cases and is preparing a nationwide R21 rollout in early 2026, following successful pilots in Kano and Kaduna states. Ethiopia, Tanzania, and Mozambique are integrating vaccines into routine EPI (Expanded Program on Immunization) schedules, targeting >80% coverage in children under two by 2028.

In Asia, India is transitioning from malaria control to elimination, with the National Vector Borne Disease Control Programme (NVBDCP) prioritizing vaccine introduction in high-burden states like Odisha, Chhattisgarh, and Jharkhand. The Serum Institute of India’s Pune facility-already producing R21 at USD 2–4 per dose-is now partnering with IAVI and Wellcome Trust to co-develop thermostable, single-dose formulations ideal for last-mile delivery. Meanwhile, Thailand’s Mahidol University and Vietnam’s PATH-supported labs are advancing novel P. vivax vaccine candidates-a critical gap, given vivax’s dormant liver-stage relapses affecting 13 million people annually in the Asia-Pacific.

Segmentation Spotlight: Pre-Erythrocytic Vaccines Dominate, But Transmission-Blocking Candidates Gain Traction

By mechanism, pre-erythrocytic vaccines (targeting sporozoites before liver invasion) hold overwhelming dominance, driven by RTS,S and R21. Their strong safety profile, compatibility with existing EPI platforms (e.g., co-administration with measles vaccine), and WHO-backed implementation frameworks make them the backbone of current programs.

Blood-stage vaccines-aimed at reducing parasite density and clinical severity-are advancing through Phase II, led by candidates such as GSK’s GMZ2 and NIH’s PfSEA-1. Though slower to commercialize, they offer complementary protection in high-transmission zones where breakthrough infections still occur.

Most strategically significant are transmission-blocking vaccines (TBVs), designed to interrupt the parasite lifecycle in mosquitoes. Though still in mid-stage development, TBVs like Pfs25-based candidates from PATH and Walter Reed Army Institute of Research represent the “endgame tool”: community-wide deployment could suppress transmission even without 100% individual coverage. With DARPA and CEPI now funding TBV scale-up initiatives, this segment is expected to grow at nearly 19% CAGR through 2035.

Cost Pressures and the Path to Sustainable, Scalable Immunization

Despite progress, cost and delivery hurdles persist. While R21’s per-dose price of USD 2-4 is a quantum leap from early biologics, the full 4-dose regimen (plus delivery, training, and monitoring) raises programmatic costs to USD 10–12 per child. Cold-chain dependence (2–8°C for R21; ultra-cold for mRNA candidates) remains a barrier in rural Africa.

To enhance cost-efficiency, stakeholders are pursuing four key strategies:

- Thermostabilization: Oxford and SII are testing lyophilized R21 formulations stable at 40°C for 6+ months-potentially eliminating refrigeration needs.

- Fractional Dosing: WHO is evaluating reduced-dose schedules (e.g., 3 µg vs. 5 µg R21 antigen) to stretch supply without compromising efficacy.

- Local Manufacturing: African Union’s Partnership for African Vaccine Manufacturing (PAVM) aims for 60% regional vaccine production by 2040, with Biovac (South Africa) and Aspen Pharmacare ramping up fill-finish capacity.

- Integrated Delivery: Bundling malaria vaccines with deworming, vitamin A, and nutrition programs cuts per-child service delivery costs by up to 35%, per PATH field analyses.

The benefits extend beyond mortality reduction: every USD 1 invested in malaria prevention yields USD 36 in economic returns via increased productivity, education retention, and health system savings (World Bank, 2024). For endemic nations, vaccines are not just health interventions-they’re engines of human capital development and macroeconomic resilience.

About the Report

“Malaria Vaccines Market Comprehensive Analysis & Growth Outlook to 2032” provides an in-depth assessment of 42 vaccine candidates across clinical and preclinical stages, detailed country-level adoption roadmaps for 28 high-burden nations, pricing benchmarks across procurement channels, and scenario analyses for outbreak-responsive deployment. The report includes proprietary interviews with 15+ KOLs, regulators, and supply-chain operators, plus exclusive modeling of impact under climate change and drug-resistance variables.

Explore the Full Potential of the Malaria Vaccines Market-Request Your Complimentary Sample Report Today

Gain access to granular data on pipeline dynamics, competitive benchmarking, regulatory pathways, and ROI frameworks for public and private stakeholders. Schedule a personalized briefing with our infectious disease team to discuss strategic entry, partnership opportunities, or custom forecasting.

👉 Download Sample Report: https://introspectivemarketresearch.com/request/20170

About Introspective Market Research

Introspective Market Research(IMR) is a globally recognized leader in evidence-based healthcare and life sciences intelligence. We empower pharmaceutical companies, biotechs, governments, and global health institutions with actionable insights, predictive modeling, and strategic advisory services-turning complex data into decisive advantage. Our team of >120 analysts, clinicians, and ex-regulators combines deep domain expertise with proprietary methodologies to forecast market evolution with unmatched precision. Trusted by WHO, Gates Foundation partners, and Fortune 500 innovators, we don’t just report on the future-we help shape it.

Media Contact:

Aisha Thompson

Director of Communications

Introspective Market Research

Email: [email protected]

Phone: +91 91753-37569.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness