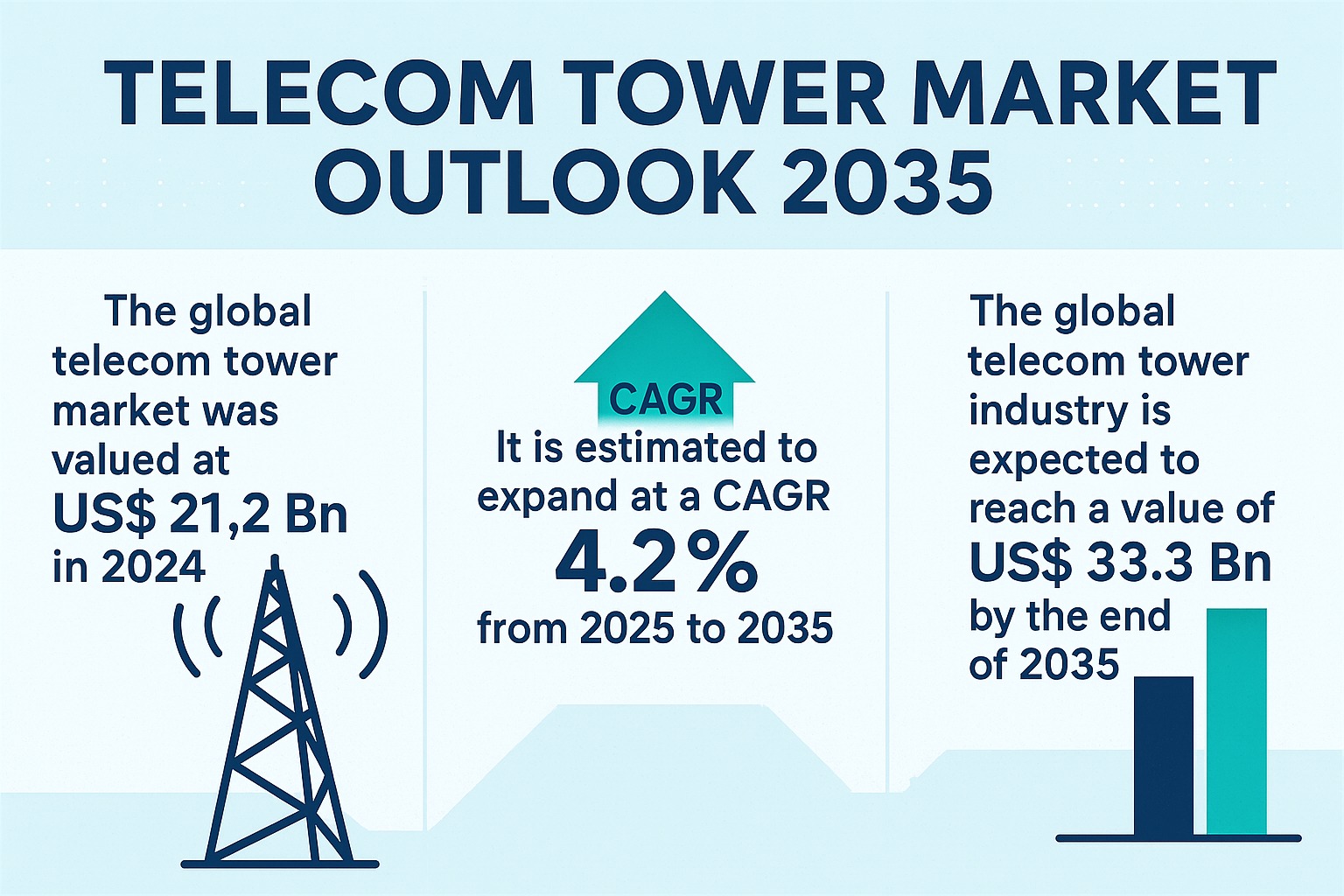

Telecom Tower Market Size to Reach USD 33.3 Billion by 2035 Driven by 5G Expansion, Rising Data Consumption, and Network Infrastructure Modernization

The global telecom tower market continues to be the backbone of digital connectivity, supporting mobile communication, data transmission, and the rapid roll-out of next-generation networks. The market, valued at US$ 21.2 Bn in 2024, is set for sustained expansion as operators and tower companies increase investments in 5G infrastructure, network densification, and fiber integration. According to industry estimates, the market is projected to expand at a CAGR of 4.2% between 2025 and 2035, reaching an impressive US$ 33.3 Bn by 2035. This steady growth reflects long-term demand for uninterrupted connectivity, the surge in mobile data consumption, and broader government-led digital inclusion initiatives.

Analysts’ Viewpoint on Telecom Tower Market Scenario

Analysts observe that the telecom tower market is undergoing consistent, transformational growth driven by the global shift toward mobility, broadband connectivity, and digital ecosystems. As millions of people rely on digital services for communication, work, entertainment, and commerce, the load on mobile networks has increased significantly. This surge is directly translating into heightened demand for robust tower infrastructure.

The rapid pace of 5G deployment, rising smartphone penetration, and exponential data consumption continue to propel tower expansion across both developed and emerging markets. Telecom towers are becoming more sophisticated, energy-efficient, and increasingly integrated with renewable power systems to meet sustainability goals. Analysts also highlight a strong global push toward tower sharing, infrastructure-as-a-service, and strategic partnerships between tower companies and telecom operators. These factors are improving operational efficiency while reducing overall network deployment costs.

Governments across Asia, Africa, and Latin America are prioritizing rural connectivity, which is encouraging investments in greenfield tower installations and multi-tenant models. As a result, the telecom tower market is expected to remain resilient, competitive, and innovation-driven over the next decade.

Telecom Tower Revenue Growth

Revenue growth in the telecom tower industry is closely tied to the rising need for network reliability, expansion of high-capacity data services, and support for advanced mobile technologies. As network operators aim to maximize coverage and provide superior data speeds, telecom towers—both macro and small cell—remain critical pieces of infrastructure.

A significant contributor to revenue expansion is the industrywide movement toward energy-efficient tower solutions, such as hybrid energy systems, solar-powered structures, and improved battery storage. These technologies reduce energy costs—one of the largest operational expenses for tower companies—while supporting global carbon reduction goals.

Additionally, leading tower companies are strengthening partnerships with telecom operators to support infrastructure sharing and co-location practices. These collaborations allow multiple operators to utilize a single tower, thereby lowering deployment expenses, accelerating rollouts, and maximizing revenue per site. In developing regions, governments are promoting public–private partnerships to expand connectivity in rural and remote areas, which is further stimulating market revenues.

Tower acquisitions, consolidations, and new build-to-suit agreements are also expanding revenue opportunities as companies aim to enhance their geographic reach and meet long-term broadband goals.

Telecom Tower Market Overview

The telecom tower market comprises companies that build, own, operate, and maintain towers essential for wireless communication. These towers support antennas, transceivers, and other radio equipment that enable mobile networks, broadband services, and wireless broadcasting. Whether in urban areas requiring network densification or rural regions needing broader coverage, telecom towers ensure seamless connectivity across all geographies.

Mobile network operators install equipment such as antennas and base stations on these towers to support 2G, 3G, 4G, and 5G services. Many towers today operate under shared-infrastructure models where multiple operators utilize the same tower, reducing capital investment and improving operational efficiency.

Modern telecom towers are increasingly integrated with energy-efficient components, including solar panels, lithium battery systems, and intelligent monitoring units. These additions support continuous network uptime while reducing environmental impact. Telecom towers thus play an indispensable role in connecting individuals, businesses, and systems while enabling advancements in IoT, smart cities, cloud computing, and digital services.

Key Market Drivers

1. Accelerated 5G Rollout Fueling Infrastructure Expansion

The global deployment of 5G networks is one of the strongest catalysts for telecom tower growth. Unlike previous generations of mobile technology, 5G operates on higher frequency bands with shorter range, necessitating a denser infrastructure of both traditional towers and small cells.

This shift is driving demand for:

- New greenfield tower developments

- Upgrading existing sites to 5G-ready configurations

- Expanding fiber backhaul systems

- Deployment of small cell clusters in dense urban areas

5G enables critical applications—from industrial automation and autonomous mobility to cloud gaming and IoT ecosystems—which require ultra-low latency and high-capacity connectivity. Telecom operators are therefore accelerating their infrastructure strategies, and tower companies are aligning their investments to support next-generation deployment requirements.

2. Rising Data Consumption and Smartphone Penetration

The explosive rise in mobile data consumption is reshaping the telecom infrastructure landscape. Billions of smartphone users engage in high-bandwidth activities such as video streaming, remote work, online education, and cloud-based services. Video streaming alone accounts for a significant share of global data traffic, with demand expected to multiply further as 4K and HDR streaming become mainstream.

This unprecedented usage surge is compelling operators to expand their network footprint and enhance capacity. Rural and semi-urban regions, once underserved, are also witnessing strong growth in mobile data adoption, pushing tower companies to extend infrastructure reach. Tower sharing is becoming a widely adopted strategy to improve cost efficiency and accelerate deployment timelines.

Lattice Towers to Dominate the Market

Lattice towers remain the dominant tower type due to their strength, durability, cost-effectiveness, and ability to support heavy antenna loads at significant heights. As demand for multi-tenant sites and 5G equipment increases, lattice towers continue to be the preferred choice for operators aiming to optimize performance and coverage.

Regional Outlook: Asia Pacific Leads the Market

Asia Pacific remains the largest and fastest-growing region in the global telecom tower industry. Countries like China, India, Indonesia, and Vietnam are experiencing massive data consumption and widespread digital transformation. Urban densification, smart city initiatives, and extensive rural connectivity programs drive tower installations across the region.

Affordable mobile data, a growing population, and aggressive 4G/5G rollouts further strengthen the region’s market dominance.

Major Players in the Telecom Tower Market

Key companies in the global telecom tower industry include:

China Tower Corporation, American Tower Corporation, Indus Towers, Cellnex Telecom, Summit Digitel, Edotco Group, Crown Castle, IHS Towers, Telenor Infra, Vantage Towers, GD Towers, Telxius Towers, Helios Towers Africa, and others.

These players deliver infrastructure solutions such as ground-based towers, rooftop structures, small cells, and fiber backhaul. Their services support mobile operator expansion, enhance capacity, and enable large-scale 4G/5G deployments.

Key Recent Developments

- 2025: The Supreme Court of India ruled telecom towers as "movable property," allowing input tax credit claims for Bharti Airtel and Indus Towers—marking a landmark decision that may boost industry investment.

- 2024: TowerCo of Africa Uganda secured US$ 40 Mn in long-term financing from European development institutions to deploy 506 telecom towers, enhancing 4G/5G coverage and promoting digital inclusion. The initiative emphasizes renewable energy and multi-tenant sharing models.

Conclusion

The global telecom tower market is on a solid growth trajectory, poised to reach US$ 33.3 Bn by 2035. With 5G expansion, massive data consumption, network modernization, and sustainability-led innovation, the industry will continue to evolve rapidly. As operators push for more reliable, high-speed connectivity, telecom towers will remain the cornerstone of global digital infrastructure for the foreseeable future.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness