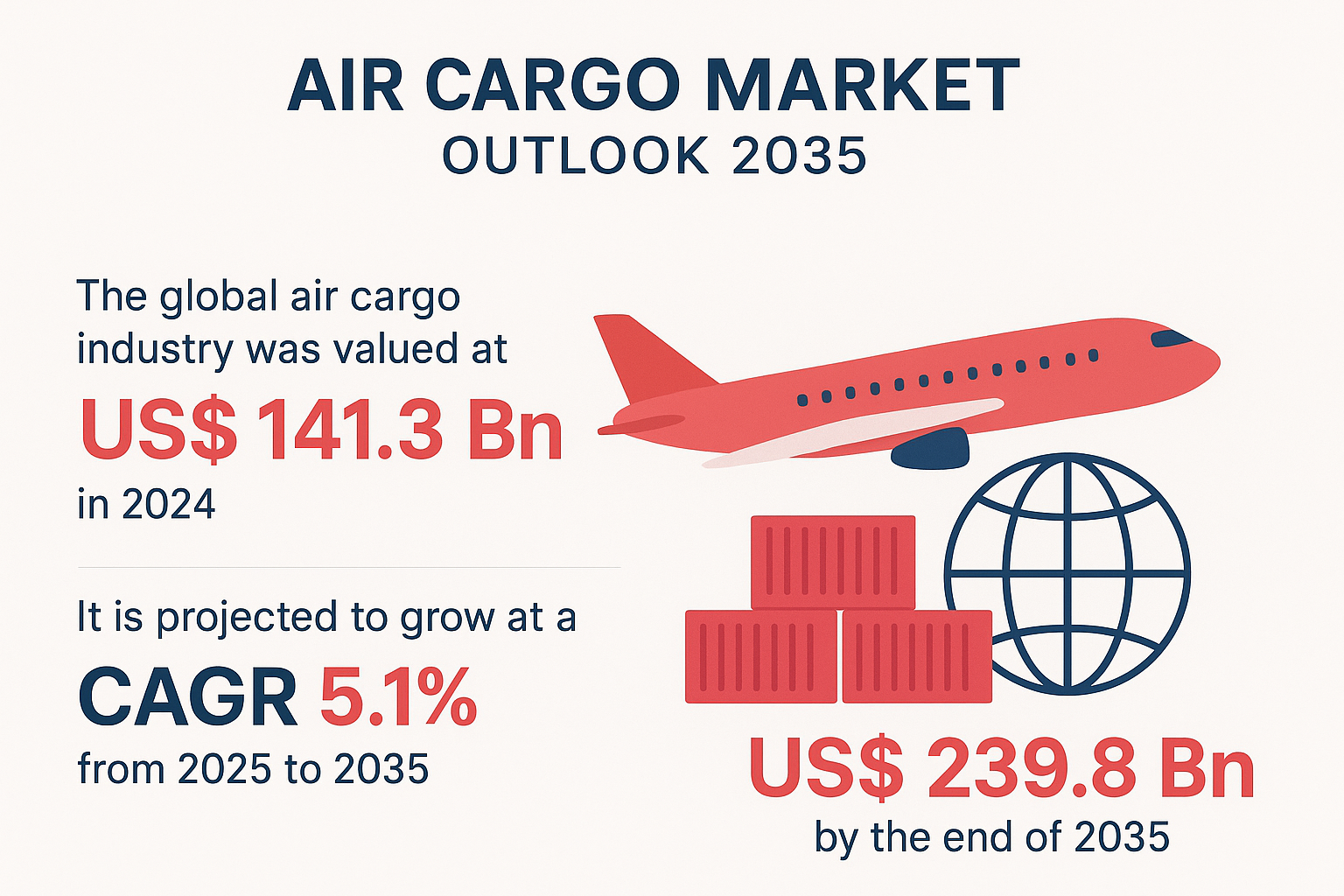

Air Cargo Market Soars Toward US$ 239.8 Bn by 2035: E-Commerce, Globalization, and Digitalization Fuel Rapid Expansion

The global air cargo market is witnessing remarkable growth as global trade, e-commerce, and the demand for faster deliveries continue to accelerate. Valued at US$ 141.3 billion in 2024, the market is projected to expand at a compound annual growth rate (CAGR) of 5.1% between 2025 and 2035, reaching US$ 239.8 billion by the end of the forecast period. The rising need for speed, reliability, and efficiency in transporting goods—especially high-value and time-sensitive shipments—has positioned air cargo as a key enabler of modern global commerce.

Analysts’ Viewpoint: Speed and Reliability at the Core of Growth

Industry analysts emphasize that the air cargo sector is a lifeline for high-value, perishable, and urgent goods such as electronics, pharmaceuticals, automotive components, and fresh produce. As international trade networks expand and supply chains become increasingly time-sensitive, air cargo has become indispensable in connecting global economies.

The growth of e-commerce has dramatically reshaped logistics expectations. Consumers now demand next-day or even same-day deliveries, compelling logistics providers to leverage air freight for faster turnaround times. Moreover, industries relying on just-in-time delivery systems—such as automotive and healthcare—depend heavily on air cargo to maintain operational efficiency and meet tight deadlines.

Air Cargo Market Dynamics

1. Digital Transformation: A Catalyst for Efficiency

The digital revolution is reshaping the air cargo industry. Companies are adopting AI, machine learning, and blockchain to enhance operational visibility, automate documentation, and improve cargo tracking. These innovations not only streamline logistics but also ensure transparency for shippers and end-users. The shift toward paperless operations and automated warehousing further contributes to faster, error-free cargo management.

Digital platforms are also facilitating better route optimization, predictive maintenance, and capacity management, helping airlines minimize costs while maximizing cargo efficiency.

2. Growing Demand for Cold Chain Logistics

The pharmaceutical and healthcare sectors are key growth drivers in the air cargo market. The transportation of vaccines, biologics, and temperature-sensitive medicines requires sophisticated cold chain logistics solutions, which rely heavily on air freight for speed and temperature control.

The COVID-19 pandemic underscored the importance of efficient cold chain systems, and the ongoing expansion of the pharmaceutical industry continues to sustain demand for air cargo. In addition, the global rise in trade of perishable food items and fresh produce adds further impetus to the market.

3. Globalization and International Trade Expansion

Globalization remains a cornerstone of air cargo growth. As more businesses participate in international trade, the need for efficient, high-speed logistics solutions has surged. Air freight provides unmatched delivery times across continents, facilitating seamless import and export operations.

According to the International Air Transport Association (IATA), global demand for air cargo—measured in cargo ton-kilometers (CTK)—grew by 11.3% in 2024 compared to the previous year, driven mainly by international shipments, which surged 12.2%. This trend highlights the pivotal role of air cargo in keeping global supply chains moving smoothly.

4. E-Commerce Boom Fueling Market Growth

The rapid rise of online retail continues to reshape the air cargo landscape. As of 2024, e-commerce accounted for nearly one-third of total air cargo volumes, up from just 10% in 2017, according to McKinsey’s report at the IATA World Cargo Symposium. The surge in cross-border e-commerce, with over 8.2 billion global orders in 2022, is expected to rise significantly through 2027.

E-commerce platforms demand faster and more reliable delivery networks, pushing logistics providers and airlines to expand freighter fleets and convert passenger aircraft into cargo carriers to meet escalating demand.

Air Cargo Market Segmentation

1. By Service: General Services Leading the Way

The general services segment dominates the global air cargo market. It encompasses freight forwarding, customs brokerage, warehousing, and consolidated cargo services, catering to a wide range of industries. The flexibility and scalability of general cargo services make them an essential part of the global supply chain.

As industries like e-commerce, pharmaceuticals, and electronics grow, the need for efficient and dependable air cargo handling continues to expand. Digital logistics management and real-time tracking technologies have strengthened this segment’s leadership by improving transparency and efficiency in cargo movement.

2. By Type and Destination

Air cargo services are categorized into air freight and air mail, with international routes dominating the market due to the growth of cross-border e-commerce and global manufacturing. However, domestic air freight is also gaining traction in emerging markets with rising urbanization and increasing domestic trade.

Regional Outlook: Asia Pacific Takes the Lead

The Asia Pacific region commands a leading position in the global air cargo market, driven by its robust industrial base, dynamic economies, and increasing cross-border trade. Countries such as China, Japan, South Korea, and India serve as major manufacturing and export hubs, generating massive cargo volumes for regional and international routes.

Asia Pacific’s strategic geographical location—linking North America, Europe, and the Middle East—makes it the heart of global logistics. Additionally, governments across the region are modernizing airport infrastructure, expanding cargo capacity, and adopting digital logistics technologies to enhance efficiency.

The growing demand for time-sensitive shipments, particularly in the pharmaceutical, electronics, and fashion sectors, continues to boost the region’s air cargo capacity. Asia Pacific’s dominance is expected to strengthen further through 2035.

Competitive Landscape: Digitalization and Sustainability at the Forefront

The air cargo market is highly competitive, with major players focusing on fleet expansion, digital transformation, and sustainability. Leading companies such as FedEx Corporation, DHL International GmbH, Emirates SkyCargo, Qatar Airways Cargo, Lufthansa Cargo AG, and Nippon Express are enhancing their networks and adopting eco-friendly initiatives to align with global sustainability goals.

Efforts such as green fuel adoption, fuel-efficient aircraft, and the IATA Fly Net Zero initiative are becoming increasingly important in shaping the industry’s future. Airlines are also expanding dedicated freighter fleets and converting passenger aircraft into cargo carriers to accommodate growing freight volumes.

Recent developments highlight this momentum:

-

In August 2025, Chapman Freeborn successfully transported oversized industrial cargo from Belgium to China using a Boeing 747-400F.

-

In April 2025, Qatar Airways Cargo, IAG Cargo, and MASkargo announced a global air cargo alliance aimed at integrating their networks and enhancing global connectivity.

Conclusion: Air Cargo’s Future is Fast, Digital, and Green

The air cargo industry stands at the intersection of speed, technology, and sustainability. As the demand for quick and reliable delivery continues to grow, the market will increasingly rely on digital innovation and green logistics to meet global expectations.

With a projected market size of US$ 239.8 billion by 2035, the air cargo sector is poised for sustained expansion—driven by e-commerce growth, globalization, and a relentless push for faster supply chain solutions. As airlines, freight forwarders, and logistics providers embrace automation, data analytics, and eco-friendly operations, air cargo will continue to play a pivotal role in powering the global economy in the decade ahead.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness