Logistics Automation Market Outlook 2035: Global Industry to Reach US$ 294.5 Billion at 10.8% CAGR Driven by E-commerce Growth

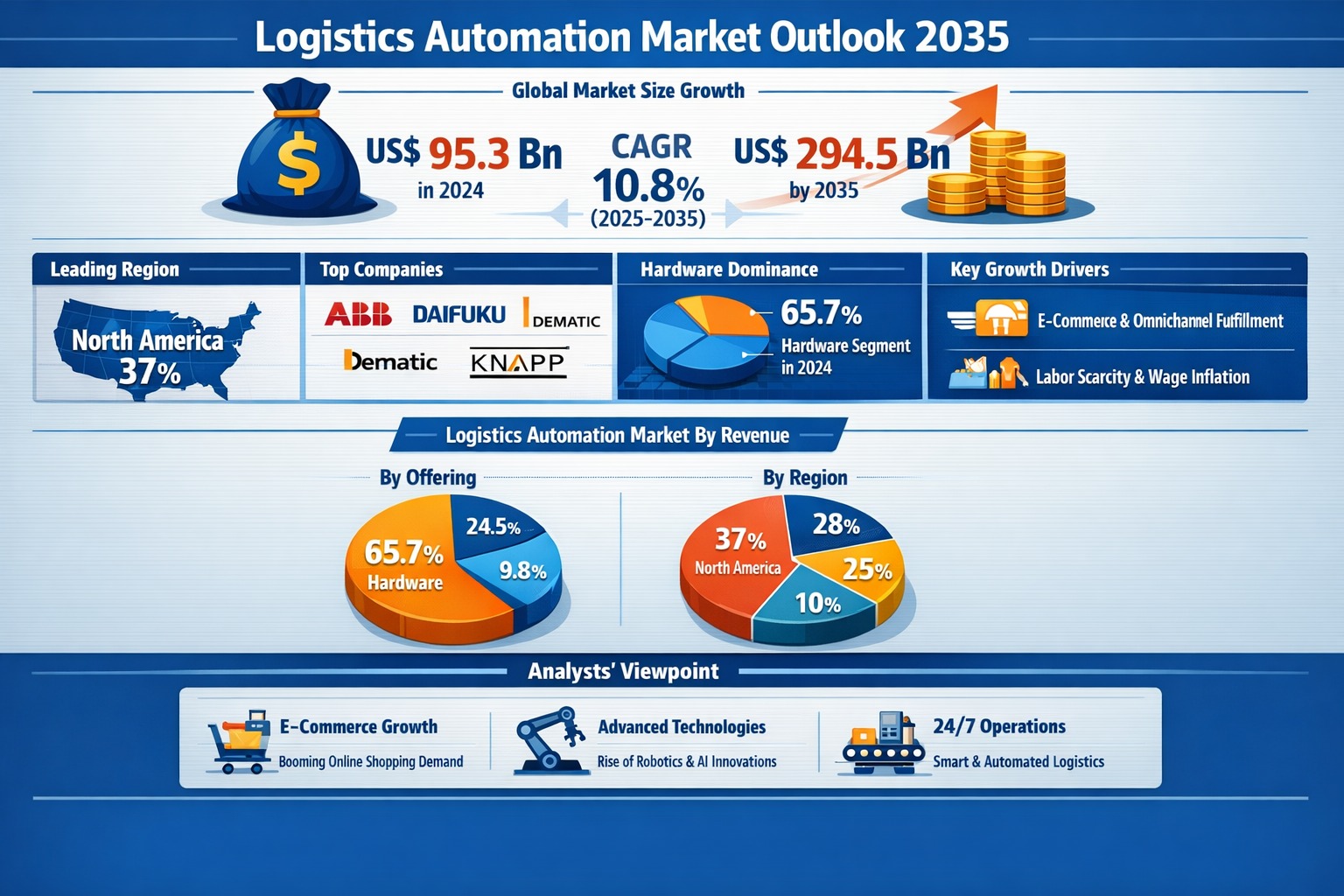

The global logistics automation market is undergoing a structural transformation as supply chains adapt to digital commerce, labor constraints, and rising service-level expectations. Valued at US$ 95.3 billion in 2024, the market is projected to reach US$ 294.5 billion by 2035, expanding at a robust CAGR of 10.8% from 2025 to 2035. This growth trajectory reflects the increasing reliance of logistics providers, retailers, and manufacturers on automated technologies to deliver speed, accuracy, scalability, and resilience across distribution networks.

Logistics automation has evolved from a cost-saving initiative into a strategic necessity. Driven primarily by the rapid expansion of e-commerce and omnichannel fulfillment alongside labor scarcity and wage inflation, automation is redefining how goods are stored, moved, picked, packed, and delivered across global supply chains.

Market Size & Key Highlights

In 2024, the logistics automation market stood at US$ 95.3 billion, reflecting strong investments across warehousing, transportation, and fulfillment infrastructure. By 2035, the market is expected to nearly triple to US$ 294.5 billion, supported by widespread deployment of robotics, automated storage and retrieval systems (AS/RS), conveyor systems, and advanced warehouse software.

Key highlights include:

- CAGR of 10.8% (2025–2035), underscoring long-term structural demand

- Hardware segment dominance, accounting for 65.7% of total revenue in 2024

- North America leading the market with a 37% revenue share in 2024

- Strong presence of global players such as ABB Ltd., Daifuku Co. Ltd., Dematic, and Knapp AG

Analysts’ Viewpoint

According to analysts, the logistics automation market is expanding rapidly due to the convergence of technological innovation and operational necessity. The surge in online shopping has placed unprecedented pressure on logistics providers to fulfill orders faster, more accurately, and at lower cost. To meet same-day and next-day delivery commitments, companies are implementing robotic picking systems, AS/RS solutions, autonomous mobile robots (AMRs), and AI-powered warehouse management systems (WMS).

Technologies such as artificial intelligence (AI), Internet of Things (IoT), robotics, and data analytics are enabling “smart” logistics environments with real-time visibility, predictive maintenance, and autonomous decision-making capabilities. These systems improve throughput, reduce errors, and support 24/7 operations—key advantages in a market increasingly constrained by labor availability.

Analysts emphasize that logistics automation is a foundational pillar of the future digital supply chain, offering long-term benefits in productivity, agility, sustainability, and cost optimization.

Logistics Automation Market Introduction

Logistics automation refers to the application of advanced machinery, robotics, and software to automate warehousing, distribution, and transportation processes. Technologies such as conveyor and sortation systems, industrial palletizing robots, AS/RS, automated guided vehicles (AGVs), and AMRs are increasingly deployed to streamline operations with high speed and precision.

Automation helps organizations:

- Reduce operating and labor costs

- Improve accuracy and order fulfillment speed

- Enhance workplace safety

- Scale operations efficiently to meet fluctuating demand

Modern logistics environments increasingly integrate intelligent software with physical automation. AI-driven orchestration tools, digital twins, and predictive analytics optimize workflows, minimize downtime, and enhance asset utilization. When hardware and software operate together, logistics automation delivers not only efficiency but also resilience and responsiveness across global supply chains.

Key Market Drivers

E-commerce & Omnichannel Fulfillment

The explosive growth of e-commerce and omnichannel retailing is a primary driver of logistics automation. Managing orders across websites, mobile apps, marketplaces, and physical stores creates immense complexity in inventory visibility and order routing. Automation enables seamless order flow—from click to ship—by synchronizing picking, sorting, packing, and dispatch processes.

In rapidly digitizing markets, rising urbanization and higher consumer expectations for fast delivery have accelerated the adoption of automated fulfillment centers. Logistics automation allows organizations to process higher order volumes with speed and consistency while maintaining service quality.

Labor Scarcity & Wage Inflation

Labor shortages and rising wages are compelling logistics providers to rethink their dependence on manual operations. Aging workforces, post-pandemic labor market tightening, and declining interest in physically demanding warehouse roles have intensified workforce challenges.

Automation offers a viable solution by ensuring consistent throughput, improving safety, and reducing dependency on manual labor. Although automation requires significant upfront investment, long-term cost savings, operational continuity, and improved system uptime make it economically attractive—especially in regions facing sustained wage inflation.

Hardware Segment Dominance

The hardware segment, with a 65.7% revenue share in 2024, dominates the logistics automation market. Heavy investments by e-commerce giants and logistics providers in robotics, conveyors, AS/RS, AGVs, and palletizing systems have driven this dominance.

Hardware delivers immediate, measurable productivity gains by accelerating material movement and reducing manual handling. While software and services are gaining importance for analytics, monitoring, and system integration, the tangible operational impact of hardware ensures its continued leadership in market share.

Regional Outlook

North America: Market Leader

North America accounted for 37% of global logistics automation revenue in 2024, driven by advanced technological infrastructure, strong capital investment, and high labor costs. The region has been an early adopter of AMRs, AS/RS, and AI-powered warehouse systems.

Major logistics and e-commerce players—including Amazon, UPS, and FedEx—have made substantial investments in automated distribution centers. Labor shortages and unionized workforce costs further incentivize automation adoption, reinforcing North America’s leadership position.

Other regions such as Europe and Asia Pacific are also witnessing rapid adoption, supported by industrial automation initiatives, expanding e-commerce markets, and government-backed digitalization programs.

Competitive Landscape and Key Players

The logistics automation market is highly competitive, with players focusing on innovation, partnerships, and portfolio expansion. Leading companies include ABB Ltd., Beumer Group GmbH & Co. KG, CIGNEX, Daifuku Co. Ltd., Dematic, Hitachi, Ltd. (JR Automation), Honeywell International, Inc., Jungheinrich AG, Kardex Group, Knapp AG, Murata Machinery, Ltd., Oracle Corporation, Seegrid Corporation, Siemens AG, Swisslog Holding AG, and Zebra Technologies Corp.

These companies are profiled based on product offerings, strategic initiatives, global footprint, and recent developments, highlighting continuous investments in robotics, software integration, and intelligent logistics solutions.

Recent Developments

In May 2025, DHL Group signed a memorandum of understanding with Boston Dynamics to deploy an additional 1,000 robots, reinforcing its cross-business automation strategy through co-development and large-scale deployment.

In the same month, WiseTech Global acquired E2open Parent Holdings, Inc., expanding its cloud-based logistics and trade management capabilities and broadening its customer base across global supply chains.

Market Snapshot and Outlook

With a strong growth outlook through 2035, the logistics automation market stands at the center of digital supply chain transformation. Backed by rising e-commerce demand, labor challenges, and rapid technological advancements, automation is no longer optional—it is mission-critical.

As companies pursue speed, efficiency, and sustainability, logistics automation will remain a key enabler of competitive advantage, reshaping global logistics operations for the next decade and beyond.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness