Door Lock Micro Motors Market Segmentation Analysis (2025–2035)

The global Door Lock Micro Motors Market exhibits a diverse and dynamic structure shaped by technological differentiation, end-use applications, and voltage specifications. Segmentation analysis helps in understanding the key areas of innovation, demand generation, and profitability across the value chain.

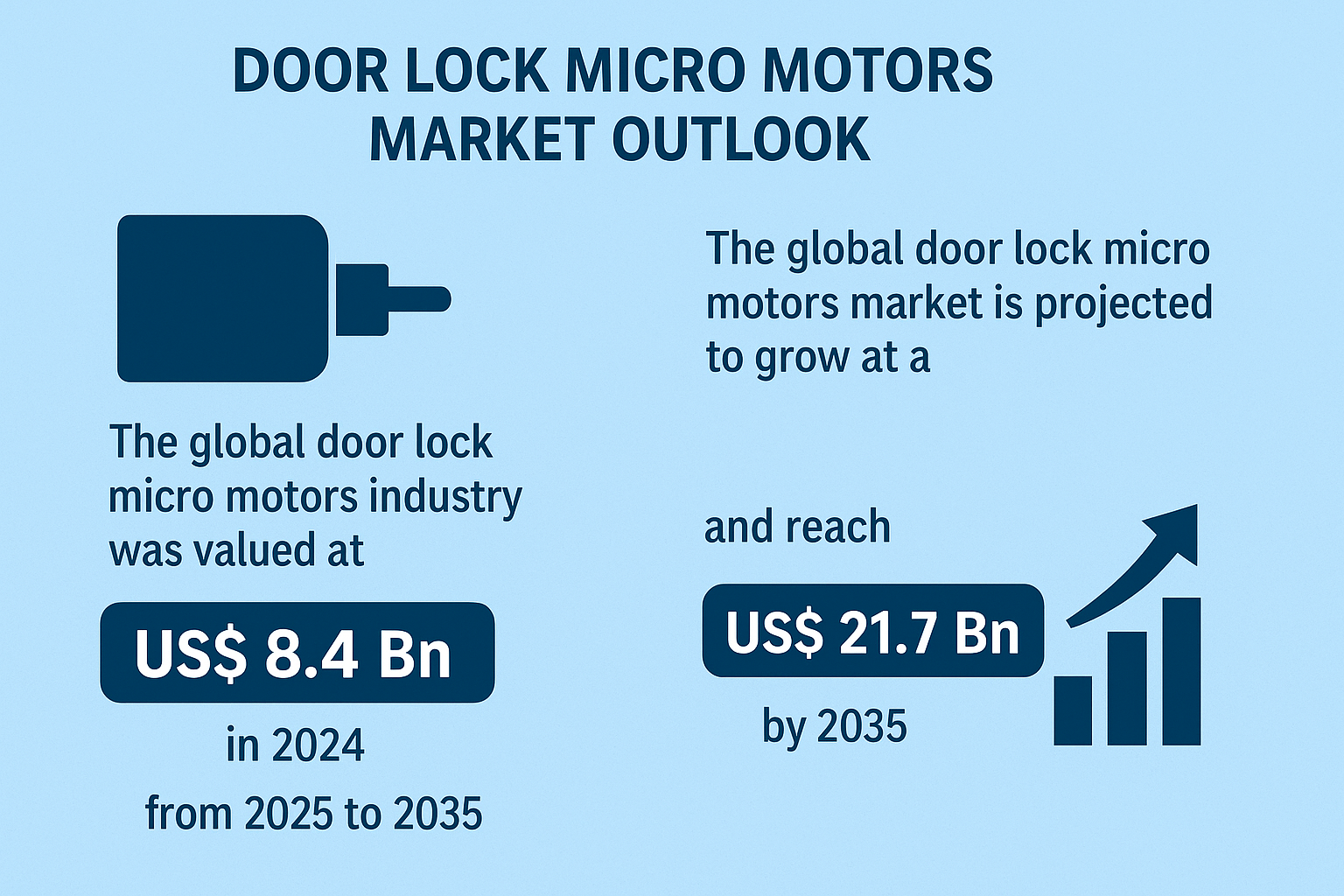

By 2035, with the market projected to reach US$ 21.7 billion, segmentation insights will play a crucial role in identifying growth opportunities for manufacturers and investors in both automotive and non-automotive sectors.

1. By Motor Type

a. DC (Brushed) Motors

DC brushed motors are among the most widely used micro motors due to their simplicity, low cost, and reliability. These motors are typically employed in automotive central locking systems and basic electronic locks, where high torque and short operating cycles are required. However, their mechanical wear and relatively lower energy efficiency compared to brushless motors have led to a gradual shift toward newer designs.

Despite this, DC brushed motors continue to dominate low-cost and mid-range locking systems, especially in developing markets.

b. Brushless DC (BLDC) Motors

The BLDC motor segment is experiencing rapid growth due to its superior efficiency, long operational life, and noise-free performance. BLDC motors are increasingly favored in premium automotive models, EVs, and smart home locks where smooth and quiet operation is essential.

They are particularly suitable for IoT-enabled locks that rely on battery power, as their low energy consumption extends the lock’s battery life. As a result, this category is expected to hold a significant market share during the forecast period.

c. Stepper Motors

Stepper motors offer precise positional control and are primarily used in digital and biometric door locks that require accurate motion regulation for bolt movement and locking alignment. Their ability to provide incremental rotation without feedback sensors makes them ideal for automated systems in smart buildings and secure commercial access points.

Growth in office automation and electronic access control systems is expected to strengthen demand for stepper motors in the coming decade.

d. Permanent Magnet Motors

These motors are known for their high power density and compact form factor, making them highly suitable for space-constrained applications such as door handles, latch actuators, and trunk locks. Their efficiency and torque stability are valuable in both automotive and industrial access systems, where consistent performance under varying environmental conditions is essential.

e. Others (Servo, AC, and Electromechanical Motors)

This category includes specialized servo and electromechanical motors designed for custom industrial locks, hybrid smart systems, and advanced biometric mechanisms. Although they currently represent a smaller share, these motors are projected to witness increased demand as AI-based access systems and robotic security modules gain traction.

2. By Voltage Rating

a. Low Voltage (<12V)

Low-voltage micro motors dominate residential smart lock systems and battery-powered applications. These motors prioritize safety, compactness, and power efficiency, ensuring long-term use without overheating. Their integration in home automation and IoT devices is expected to grow as more consumers adopt wireless, portable smart locks.

b. Mid Voltage (12–24V)

This segment caters primarily to automotive and commercial door locking systems. Motors in this range deliver higher torque and durability, suitable for vehicle door actuators, sliding gates, and office door systems that operate under continuous use. As electric vehicle production increases, mid-voltage micro motors will see substantial growth.

c. High Voltage (>24V)

High-voltage motors are typically deployed in industrial and infrastructure-grade applications—such as access control in government buildings, factories, and smart city projects. Their ability to handle high load cycles, environmental variations, and heavy-duty locking operations makes them essential for advanced security and automation systems.

3. By Lock Type

a. Digital / Electronic Door Locks

Electronic locks form the backbone of modern access control systems. They use micro motors to operate mechanical latches based on electrical input, allowing integration with keypads, RFID cards, and sensors. Growing commercial infrastructure and multi-tenant systems are fueling this segment.

b. Electromechanical Locks

These locks combine traditional mechanical design with electrical operation, balancing durability and modern control. They are common in automotive and industrial settings, providing a reliable transition between manual and smart locking mechanisms.

c. Biometric Locks

Biometric locks—using fingerprint, facial recognition, and iris scanning—are among the most advanced security systems. They rely on precisely calibrated micro motors for instant, accurate mechanical actuation. Demand for biometric locks is expected to surge in corporate offices, hospitality, and high-end residential sectors.

d. Smart Locks / IoT-Enabled Locks

The smart lock category is the fastest-growing segment, driven by the adoption of AI, IoT, and voice-controlled home automation systems. These locks utilize energy-efficient BLDC or stepper motors to manage real-time connectivity, remote monitoring, and integration with smart ecosystems like Alexa and Google Home.

e. Others (Hybrid and Specialized Locks)

Hybrid locks integrate both mechanical keys and digital access, catering to transitional markets where full digital adoption is yet to occur. Specialized locks are also emerging in logistics, medical facilities, and public infrastructure, further expanding the scope of micro motor applications.

4. By End-use Industry

a. Automotive

The automotive sector remains the largest end-use industry, with micro motors deployed in power door locks, trunk actuators, and central locking systems. EVs, in particular, are propelling demand for lightweight, energy-efficient BLDC motors.

b. Residential (Smart/Home Locks)

Rising adoption of smart home technologies and consumer emphasis on convenience and safety are fueling strong growth in this segment. Micro motors power keyless, voice-activated, and app-controlled door systems.

c. Commercial Buildings / Offices / Hotels

The hospitality and office automation sectors are rapidly adopting digital locking mechanisms to enhance guest experience and streamline access management. Integration with centralized building management systems (BMS) drives this segment forward.

d. Industrial / Government / Infrastructure

Industrial environments and public buildings require heavy-duty electromechanical locks capable of sustained operation under demanding conditions. These systems rely on robust high-voltage motors designed for long-term reliability.

Conclusion

The segmentation of the Door Lock Micro Motors Market highlights the technological diversity and application depth across multiple industries. From low-voltage smart locks in residential use to mid-voltage automotive systems and high-voltage industrial access control, micro motors are enabling the evolution of intelligent, connected security systems worldwide.

As innovation continues, manufacturers that specialize in energy-efficient BLDC motors, compact stepper designs, and IoT integration are best positioned to capitalize on the expanding global demand through 2035.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness